Are you considering using Tally ERP 9 for your business’s accounting needs? Hold off before making that decision. While Tally ERP 9 may be a popular accounting software, it has its fair share of drawbacks. From being complex and not user-friendly to offering useless paid upgrades, tt can slow down your accounting process and be a source of frustration for small businesses with limited resources.

Let’s look at why Tally ERP 9 may not be the best fit for your business and offer an alternative solution to consider.

Why You Shouldn’t Use Tally ERP 9

Let’s explore why Tally ERP 9 may not be the best choice for your accounting needs.

1. Complex UX/UI:

It is not user-friendly software and requires a qualified accountant or at least two years of experience with the software to use it effectively. Small businesses with limited resources may find it challenging to use Tally ERP 9. Simply put, it requires expert or at least intermediate-level accounting knowledge in order to work.

2. Software That Only Uses One Screen:

The software does not allow you to work on more than one ledger at a time, which makes it challenging to review work while making entries into the ledger. This slows down the accounting process.

3. Pointless Paid Upgrades:

Upgrades for Tally ERP 9 are expensive and offer little noticeable difference. It costs between AED 1000 and AED 2000 per installation for Tally Partners to make upgrades.

4. Not Useful for Multi-Branch Operations:

It is not ideal for multi-branch operations. To operate Tally from multi-sites, you must use VPN and invest in servers and LAN bundled with Tally.net. Consultancy and implementation costs can add up.

5. No Flexibility of Changing of Chart of Accounts:

Tally ERP 9’s lack of a default setting button can cause frustration and time wastage. Changing settings after configuration settings are completed requires restarting and deleting all ledgers, making it a rigid and challenging software to use.

6. No Central Support:

Tally ERP 9 lacks centralized support, forcing users to rely on the partner network, whose fees and level of expertise can vary.

7. Low Security:

Losing your password can be a security risk as it can be challenging to retrieve data without it.

8. Loss of Data:

Since it is desktop or server-based, the risk of losing data due to machine crashes or viruses is high.

9. No Customization or Module Integration:

It does not support the customization or integration of other applications, and it cannot be customized.

So, What’s the Alternative?

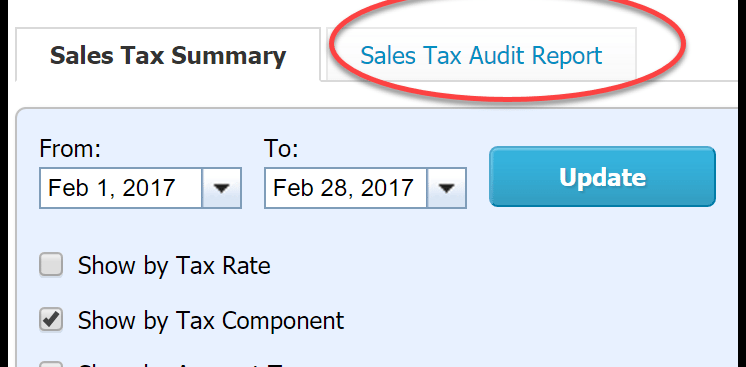

If you are looking for an alternative, consider Xero Cloud Accounting Software. Xero is a user-friendly and efficient cloud-based accounting software that allows for multi-branch operations, flexible chart of accounts, and customization. Xero also offers central support and high-security features, making it a safer and more effective accounting solution.