The FTA has produced a very concise document on the required functions of accounting software which are needed to produce the FTA Audit files (“FAF”) for VAT and Excise Tax should they ever request it.

What is accounting software?

Accounting software should be a key part of any modern growing business whether a retail store or a service provider and it is not something reserved just for large corporations.

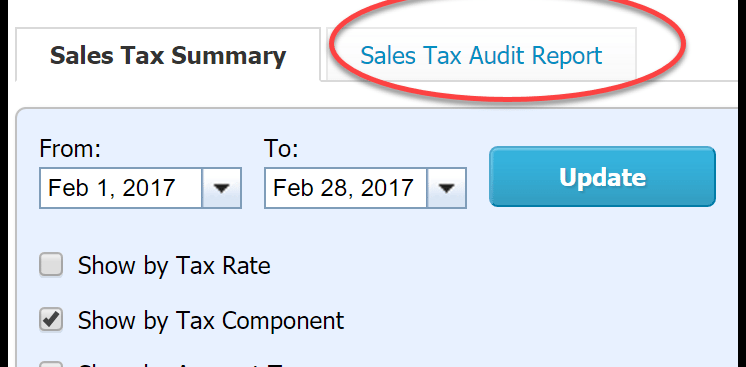

Currently, there are many accounting software solutions being used in the UAE the key players in the market are:

When selecting an accounting solution business owners should ensure that the solution complies with the FTA registration requirements.

Any competent accounting software should be able to produce Sales Invoice, Accounts Receivable, Accounts Payable, and General Ledger but the FTA has very specific requirements, namely the need to generate a FAF File.

FTA Audit File

FAF is something that could be requested by the FTA whilst conducting a periodic audit to ensure that tax and returns have been prepared correctly. It is strongly recommended that businesses check with their software vendors to make sure they are able to produce FTA Audit Files (FAF) if required, otherwise it would be a very costly exercise to do on-demand.

NOTE: It may be possible that your software is able to produce data in FAF but your accounting partner failed to implement and monitor the documenting of the transactions as per the FTA Requirements and you only realize when the FAF is requested at which point it could take weeks to rectify.

Key Elements to be present in the FTA Audit File (FAF) are:

- Company Information such as Company Name and TRN No.

- Master Files

- Supplier File

- Name of Supplier

- Location of Supplier by Emirates

- TRN No. if applicable

- Customer File

- Name of Customer

- Location of Customer

- TRN No. if applicable

- Source Documents

- Purchase Invoices, Imports, Credit Notes (with all details)

- Sales Invoices, Credit Noted Issued to Customers (with all details)

- Payments

- Transaction Date

- Payment Date

- General Ledger

- Product File

- Supplier File

In summary, your accounting software must be able to produce all or any of the above if requested by the FTA during a periodic audit of your VAT Return.

Profits Plus Accountants

We are a British Accounting Firm based in Dubai and we help businesses navigate the FTA requirements using the cloud accounting software in the World.

We make sure that you remain 100% compliant.

As a Silver Partner of Xero Cloud Accounting Software, we have a local team based in Dubai with over 20 years of experience (collectively).

If you are looking for an accountant in Dubai then speak to Ali Afzal, a Managing Partner at the firm. You can reach him directly on a.afzal@profitsplus.ae.

Note: www.profitsplus.ae is a domain belonging to Profits Accounting and Bookkeeping, an accounting and bookkeeping firm registered with Dubai Economy, Trade License No. 796316.