Almost everyone knows governments collect taxes from the masses to run their affairs. So, just like every other country, the government of UAE started collecting VAT in 2018. So, let’s start at the beginning, what is VAT? VAT stands for Value Added Tax and applies to the use or consumption of goods and services. At the point of sale, an imposition of 5% VAT occurs. The government collects taxes via businesses.

Now that we understand what VAT is, let us see how it takes effect in the UAE.

VAT in UAE

2018 saw the introduction of the tax in question. The rate of VAT in UAE, as in most cases, is 5%. The tax serves as an income source for the government, which can utilize to provide quality public services. However, businesses can also take leverage from the VAT accounting UAE has to offer for businesses.

VAT Criteria for Registering

It is compulsory for a business to register for VAT if its imports and taxable supplies, among other things, are more significant than AED 375,000 per annum. Other companies whose imports amount to less than AED 375,000 are not obligated to pay. It is optional for those whose supplies rise above AED 187,000 per annum. For this, you can easily hire any accounting and auditing companies in Dubai to register your business.

As we stated before, businesses help the government collect VAT. In return for its services, the government gives the businesses a refund on tax. Foreign businesses may also take part in this endeavor while visiting the UAE, as there is no restriction for local and national businesses to be the sole VAT collectors.

Guidelines to Register for VAT

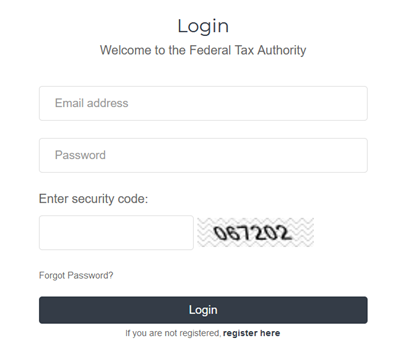

Usually, the process starts by going to the FTA (FTA stands for Federal Tax Authority) website and into the eServices section. Businesses need to establish an FTA account; only then will registration be possible. In case you have any questions or concerns about how to proceed on the matter, you are free to get in touch with Federal Tax Authority. Or for a more direct helpline, call on either 600 599 994 or 04-7775777. This is something that everyone thinking about starting a business in Dubai should know.

Imposition of VAT on Businesses

VAT applies to tax-registered businesses located both on the mainland and within the free zones. But if a company is located in a free zone which is defined as a designated zone. A designated site, by definition, is not a part of the UAE and hence does not come under the jurisdiction of the UAE government. The exchange of goods between such zones is free of tax.

VAT Return Filing

Business registered for VAT and other ‘taxable persons’ (any person who carries out a business independently within the EU or anywhere else) is under the requirement to put forward a ‘VAT return’ to the FTA. They are to do this at the close of every tax period. VAT returns basically account for all the purchases and supplies that a business or individual has made over a given period, as well as their VAT liability. Still, if you don’t know how to proceed, then contacting any reputable accounting services in Dubai will come in handy.

What is VAT Liability?

Tax difference between output tax, which is payable for a specific tax term, and the input tax, which is restorable within that period. The output tax is the VAT imposed on goods and services, and the input tax is those on purchases. This is VAT’s liability. When the output tax is higher than the input, the difference is the payment that the FTA demands in that case. However, if the input tax is higher than the output tax, the business or taxable person in question will have extra input recovered. This input tax can be set off from subsequent payments due to the FTA.

How to file a VAT return?

This process is online now. You can go to eservices.tax.gov.ae and file your VAT return.

Now that you know all the basics, what are you waiting for? Get registered for the VAT! It is best to read through the FTA guidelines to answer the more specific questions. However, suppose you don’t want to get involved in these complicated papers works. In that case, you can engage a reputable firm such as Profits Plus Accountants to do it for you!