FTA has made the VAT implementation mandatory for businesses (under certain circumstances), and every taxpayer has been extra careful about registering its company on time to avoid hefty fines. But what they do not usually care about is “VAT deregistration”, which also results in administrative penalties when not done on time.

Before initiating the process of VAT deregistration, you should understand its rules & regulations, eligibility, and timeframe.

VAT Deregistration

VAT deregistration is a crucial and legal procedure in UAE where only VAT registered businesses under Federal Tax Authority or taxable individuals forward their applications online to cancel their Tax Registration Number (TRN) if they fulfil the requirements. It makes a taxable person free from submitting tax returns following the 2017 Federal Decree-Law No. 8.

Conditions for VAT Deregistration

You must deregister yourself in case of meeting any of the following criteria to save yourself from fines and penalties of late deregistration.

Compulsory VAT-Deregistration

- Businesses or individuals who used to deal in taxable supplies have stopped.

- Businesses or individuals are no longer expected to get involved in taxable supplies for the next 12 months (1 year).

- The taxable company is still doing business in taxable supplies, but the total annual amount of money they are making out of it is lesser than the minimum Mandatory Registration Threshold, which is AED 375,000.

Voluntary VAT-Deregistration

- The taxable individual is still dealing in taxable supplies, but the total annual amount of money he is making out of it is lesser than the minimum Voluntary Registration Threshold, which is worth AED 187,500.

Criteria for Groups

In addition to the requirements mentioned above, you must fulfil the following conditions to cancel your group VAT registration:

- The applicant must not be meeting the group’s official criteria to be considered as its identity.

- The companies that used to be part of the group are no longer financially linked with the group.

- In the case of continuing VAT registration, there are chances of incidents of tax evasion.

Time Frame for VAT De-registration

Every registrant is legally permitted to deregister himself from VAT through Federal Tax Authority portals within 20 business days or less, counting from the day when the taxpayer becomes eligible for VAT deregistration.

Penalty for Late VAT Deregistration

In case of failure to deregister your company within 20 business days (timeframe), you are penalised with 10000 AED as a late fee, and then your company will be deregistered.

The Process to Deregister

Before applying for deregistration, you must clear all of your outstanding liabilities. You can check your total due amount (if any) in the “My Payment tab.” If you are clear of debts, proceed with the applications.

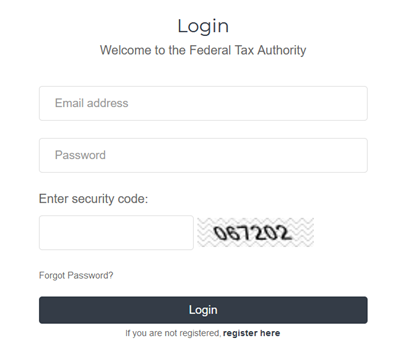

- Visit FTA official site and log in to the portal with your proper credentials.

- You will see a dashboard where you need to find and click on the ‘De-Register’ button (placed against the VAT registration).

- The portal will ask for complete personal information that you must provide correctly and truthfully. Technically, the portal tends to have your fully detailed data already saved, but you must recheck it, especially the e-mail address of the authorised participant.

- Go to the ‘Choose Files’ and upload all the required documents as evidence.

- You must pick one of the suggested reasons to deregister from the provided drop-down list.

- After reading the necessary declarations, finalise your deregistration application and submit it.

Status Details

- First, your application will enter the “pending” phase, waiting to receive FTA’s processing approval. You can see the pending status mentioned on your dashboard.

- Then it reaches the “submitted stage”, where you are informed about the processing acceptance and will be asked to provide additional information.

- Here comes the “pre-approved stage”, confirming your application approval but showing that you have pending liabilities.

- Once you have no liabilities left, your business will be deregistered.

Reasons for the Application Disapproval

- The application is submitted after the due date (after 20 business days).

- The application is missing the required tax returns.

- The data is incomplete or faulty.

- The individual is left with unpaid credits, tax, or fines.

How Can Profit Plus Help?

With the professional assistance of our well-trained British accountants, you can tackle your VAT concerns better. Whether it is about VAT registration, submission, implementation, deregistration, or accounting, we provide the necessary guidance to give your application greater chances of approval and assurance to your business.

Profit Plus offers much more than VAT deregistration services, such as SOPs, Cash flow management, and BPI consultant services.