For starters, for a business to grow and expand, the annual financial data is very important to devise strategies for the next fiscal year. For a better understanding of the operations of the enterprise, the managerial hierarchy must have access to clear, correct and latest data and information of their enterprise.

Now the term cloud computing has been around for a long, we’ve seen many iterations of accounting software come and go. This has allowed the business market to evolve and become breeding grounds for more competition. That makes sure that the quality of the products/services can always be held to a standard that is best for the consumer- basic economics.

As we all know by now these nifty cloud computing services allows the right people to access the data at their whim, provided they have the necessary permits to access the data.

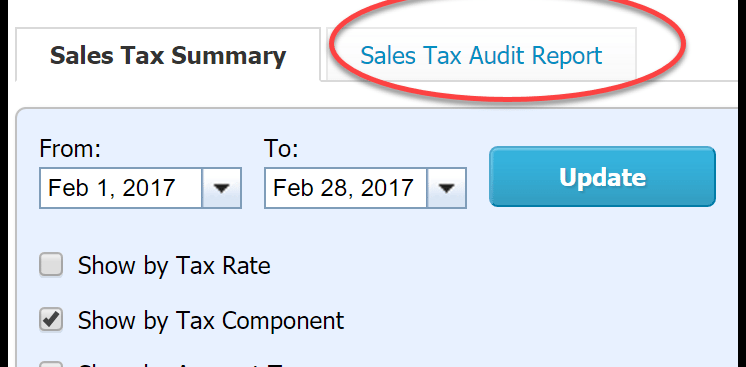

These days cloud computing services are now readily available for businesses of all sizes and operations in Dubai. That is made possible through the use of accounting software like Xero and Saasu which are used by all leading firms. It offers an extensive range of accounting services which include SMSF audit, taxation, financial management and accounting outsourcing services. This software can manage operational bookkeeping of businesses which can help keep track of the business transactions, but they both have some differences in comparison.

Xero and Saasu have several similar qualities when we talk in accounting terms, mainly revolving around pricing and transactions. The user-friendly accessibility allows users a wide range of formatting, printing and mailing options. Both the software are available in various currencies as well, enabling people from all parts of the world to reap the benefits from using them.

Xero

- Xero (accounting software) has fairly high demand these days amongst the accounting fraternity mainly because of its ease of access.

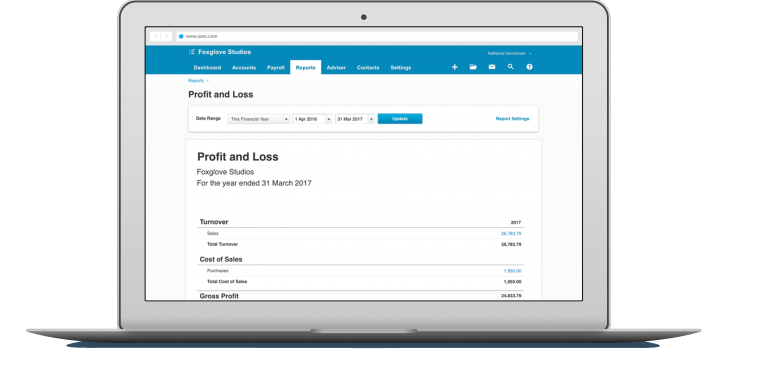

- Xero contains an all-inclusive payroll tool that facilitates the user to manage employee payroll obligations suitably by creating ABA files. These files are meant for the majority of the employee payments, track employee entitlements, and execute an automated super payment process.

- Xero has exceptional integrational abilities for third party add-ons that help raise the system functionality.

- Xero is a timesaver essentially, the bank feed feature reduces bookkeeping time and costs.

- Xero is user-friendly and customisable, with more options for the user to prioritize financial aspects.

- Xero provides different types of invoicing, enabling business operations to be accessed easily when needed.

Saasu

- Saasu (accounting software) enables the conversion of sales quotes into individual invoices. Making it a must-have for businesses in the construction sector and also for trading businesses that have a high sales volume.

- Saasu focuses more on inventory and accounts associated with it. users can gain access to PO’s and send them to suppliers. The system at the backend tracks this movement via the inventory.

- Saasu allows its users to mail invoices in large volumes, all while providing highly customisable email templates as well.

- Saasu like Xero can easily incorporate third-party add-ons to bolster system functionality

It has been made clear what features both software have to offer. Using either of them relies upon the nature of your business and what you as the user are looking for.

But the appeal of Xero is unparalleled in its capabilities. Xero is the complete package with so many benefits and can offer so much more to owners than any other accounting software. If you want to go for the best accounting software for small businesses, opt for XERO!