ABC OF CHANGING YOUR ACCOUNTANT IN DUBAI

Accountancy is a fundamental part of any business and it is vital that accounting duties are executed properly. Moreover, than just dealing with the figures, most accountants offer a full-circle service of managing tax, bookkeeping and often payroll too which makes them a key part of many companies. But what happens if the service that your accountant is providing falls short of your expectations? Many people do not realize that changing your accountant if you are unhappy could be easier than you think.

1) Consider why you are unsatisfied

There are a number of common complaints which people may have with their accountancy service. Some of the most typical ones tend to lack communication with accountants failing to answer calls or respond to emails or not doing this in a timely fashion. Other problems center around fees charged by accountants with many finding this to be erratic and different each month making it hard for companies to budget for accountancy costs. Some also find that it difficult to meet costs when accountants charge them per phone call or email making it an expensive affair to seek even the simplest advice. Here are the complaints we hear the most:

- Phone calls and emails are not returned in a timely manner…or not at all.

- Proactive tax planning and strategic advice from the accountant simply don’t happen.

- Tax returns are often put on an extension instead of being filed on time.

- Inadequate answers are given to questions about tax law.

- The invoice amount is a “surprise”… after the services have been provided.

- Frequent correspondence is received from the government due to simple filing errors.

- An accountant is distracted from serving clients due to having other business interests.

The good news is that if you are unsatisfied with the service that you are paying for from your accountant, you do not have to suffer in silence.

2) Find a new accountant

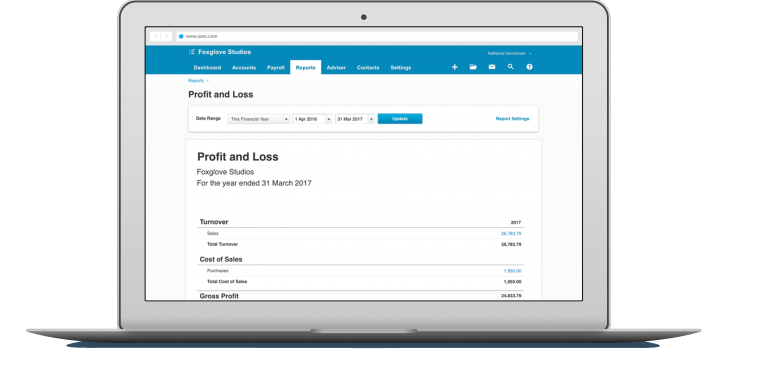

This may seem like an unusual step, but the consequential tasks will make it clearer why this may be a beneficial first port of call. Firstly, consider the aspects of your current accounting offerings which are making you unhappy. If it is the unforeseen costs or ‘bill surprises’ then you could benefit by looking at accountancy firms that charge a fixed fee for their services, so you always know what you are going to be charged regardless. Whether you decide on a fixed-fee service or charge per service accountant, you should ensure that all chargeable fees are made transparently clear to you right from the beginning to avoid any surprises.

Another fundamental aspect is choosing an accountant that provides a comprehensive service, accountants use jargon on a daily basis, but a good accountant should be able to make all communication clear and stable for their clients. Most accountants will offer a free no-obligation initial chat which could help you to decipher if they could be right for you. Moreover looking for an accountancy firm who is members of well-established professional bodies like the Institute of Chartered of Accountants could offer you further peace of mind.

3) Switch over

It really could be as simple as that. In contrast with the misconception that changing accountants is a practically impossible affair, your new accountant could handle the whole switching process for you taking the weight off your mind.

Your accountant could write to your previous accountant and request all the necessary paperwork. You will need to sign a change of accountants’ letter which most accountants can provide you with and guide you through. People often worry that they may offend their previous accountant but the truth is that most firms have clients who move on at some point for one reason or another and will be used to dealing with this, members of the Institute of Chartered Accountants are trained on how to deal with this.

The most important thing is that you are paying for an accountancy service that you are fully satisfied with. Once the switchover has taken place, the final step is to discuss your business needs in detail with your new accountancy firm and explain exactly what you are hoping for so that they have the relevant information to provide you with the best possible solution.

So, if you are out there worried about replacing your current accountants, in this economic climate, don’t settle for less and contact us at profitsplus.ae to sort your accounting needs now.